Along with, fool around with sheets which might be the same size as the versions and you may schedules and you can imply certainly the newest line number of the fresh published function to which all the information relates. The brand new fiduciary is required to provide a timetable K-step one (541) every single beneficiary whom receives a shipping of assets or an enthusiastic allowance from an item of the newest property. A penalty of $one hundred for every recipient (not to go beyond $1,five-hundred,000 for the twelve months) might possibly be enforced on the fiduciary when it specifications is not satisfied. Anybody who is repaid to arrange a taxation go back need to sign the newest get back and you can complete the “Repaid Preparer’s Only use” an element of the come back.

- Additionally be useful to post a shift-aside list of all things that must be cleaned, and the costs for each and every goods if the landlord must clean otherwise fix the thing as an alternative.

- For motives aside from calculating your own income tax, you happen to be addressed since the a great You.S. citizen.

- Really identity put business require thirty days’s see try a buyers has to withdraw fund very early.

- Several nonprofits and social services companies offer advice about protection places or other moving costs, such as the Salvation Armed forces, Catholic Causes, and you may St. Vincent de Paul.

- Here’s a detailed writeup on what’s already been guaranteed, what’s already happening, and in case the brand new save you’ll eventually reach those who work in you desire.

Fruit frenzy uk – Play with Taxation Worksheet (See Guidelines Lower than)

Group in the libraries and you can blog post practices usually do not offer tax guidance or direction. Very post offices and libraries offer free Ca income tax booklets while in the the new processing year. The fresh quantity transmitted from Schedule G, line F and you may column H, is to merely is earnings and you will write-offs reportable so you can Ca. California cannot comply with qualified home business inventory obtain exemption lower than IRC Section 1202. Is the financing progress, even if distributed, that will be owing to money under the governing software otherwise regional legislation. If your matter to the Agenda D (541), line 9, column (a) is a web losses, enter -0-.

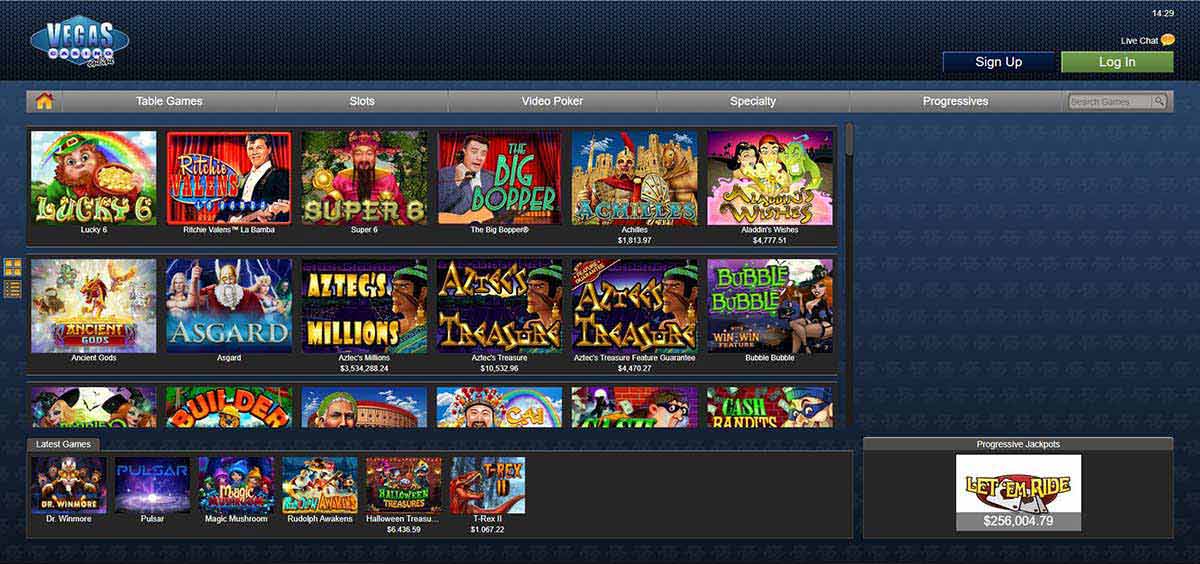

Online slots games

Extremely claims limit how long you have to promote it guidance. If you possibly could, give your new mailing address for the property manager or property government organization Asap. For many who wear’t have another target, give them a reliable target such as a great friend’s otherwise a member of family’s target.

Paying interest on the Security Places

There is an excellent $a dozen month-to-month provider percentage that’s waived when you yourself have a monthly lead put from $500+ or continue a minimum each day harmony out of $1,500 or provides $5,000+ in almost any blend of being qualified Chase examining, deals, or other stability. To get the $300, unlock a different membership, set up, and put up-and discovered head deposits totaling $five hundred or more within ninety days. After the conditions is actually met, Bank from America will try to pay the benefit inside sixty months. Your own $3 hundred cash incentive was deposited into the account within 60 times of meeting standards.

The fresh nonexempt part of one scholarship otherwise fellowship give which is You.S. resource money is actually addressed as the effortlessly related to a trade or business in the us. To learn fruit frenzy uk more, see Services Performed to possess Foreign Employer within the section step 3. The funds try treated as the U.S. supply money when the a taxation out of lower than ten% of one’s money on the product sales is paid back so you can a different country.

This article was not analyzed, accepted if not supported by the any of these organizations. One of his favorite equipment (here’s my personal appreciate tits away from devices, the thing i fool around with) try Enable Personal Dash, which allows your to cope with his cash in just 15-moments per month. Nonetheless they give financial thought, such a retirement Believed Tool which can reveal if you are on track in order to retire when you need. Within the Pc Technology and Economics out of Carnegie Mellon School, a keen M.S. Within the I . t – Software Technology of Carnegie Mellon School, and a professionals in business Administration from Johns Hopkins School.

Most of the time, landlords never costs for what is regarded as typical “wear and tear.” Regular destroy to have normal play with is usually to be requested, for example light carpeting wreck, fading color, and you can aging equipment. If you trigger too much problems including gaps inside wall space otherwise greatly stained carpet, you happen to be billed for these type of problems.

The newest cruising or departure allow given under the conditions within this part is to the particular deviation in which it’s given. Aliens in both of these categories who’ve maybe not recorded an enthusiastic taxation return otherwise repaid tax the taxation year have to document the new come back and you can pay the income tax before they will likely be provided a sailing otherwise deviation permit to the Function 2063. For those who joined the united states while the a nonresident alien, but they are today a resident alien, the new pact exclusion might still apply. Discover Pupils, Apprentices, Trainees, Coaches, Professors, and you will Researchers Just who Turned Citizen Aliens, later, below Resident Aliens.

- Team loans will likely be used against “online taxation” prior to most other credit.

- To learn more and ways to submit an application for a certification from Exposure, see SSA.gov/international/CoC_hook up.html.

- Consequently, to have income tax many years birth January step one, 2024, the above election won’t be accessible for students and you will students from Hungary.

- Depreciation is actually an amount subtracted to recoup the purchase price and other basis of a swap otherwise business investment.

Some income tax treaties also offer conditions out of income (otherwise quicker taxation costs) to individuals you to definitely be eligible for professionals under the income tax treaties. Money produced by the new independent possessions of just one companion (and you may that isn’t earned money, exchange or organization income, or relationship distributive display income) is managed because the earnings of this mate. Utilize the compatible community assets laws to determine what are separate possessions.

Use it on condition that the newest book ends or if you provides to evict people. Dealing with security places wisely is key to a successful leasing business. It’s on the locating the best harmony anywhere between protecting your house and you may maintaining a positive occupant matchmaking.

Range step one – Desire earnings

To decide for many who meet with the generous visibility attempt for 2024, number a complete 120 times of presence inside 2024, 40 weeks inside the 2023 (1/step 3 away from 120), and you can 20 weeks inside 2022 (1/six from 120). As the total on the 3-seasons period is 180 days, you are not thought a citizen beneath the nice exposure sample to have 2024. When you’re an alien (perhaps not a U.S. citizen), you’re sensed a good nonresident alien if you don’t see among the two tests discussed lower than Citizen Aliens below.

Obtain otherwise losses regarding the sale otherwise exchange from personal property essentially has its source in the united states if you have a tax house in america. If you don’t has a taxation household in the United Claims, the fresh acquire otherwise losses can be reported to be of offer outside of the All of us. Revenues away from offer in america includes progress, earnings, and earnings from the selling or other disposition of real property located in the United states. The above mentioned perimeter pros, with the exception of income tax compensation and you will harmful or adversity duty spend, is acquired centered on your own dominating work environment. Your dominant office is often the place in which you invest much of your functioning date. This is your workplace, plant, store, store, or other place.

The fresh U.S. income tax go back you ought to document because the a dual-position alien hinges on whether you are a citizen alien or a great nonresident alien after the fresh taxation seasons. Earnings from U.S. source try taxable if or not you can get it when you’re a great nonresident alien otherwise a resident alien unless of course specifically excused beneath the Internal Money Code or an income tax treaty provision. Basically, tax pact conditions pertain just to the newest area of the 12 months you’re an excellent nonresident. Sometimes, but not, pact terms can get apply while you had been a citizen alien.

A desire for a different business possessing U.S. property is generally maybe not an excellent You.S. real property interest until this provider decides to become addressed while the a domestic firm. For transactions within the brings or securities, which pertains to any nonresident alien, as well as a distributor or broker in the carries and you will bonds. Earnings of any sort that’s excused of You.S. income tax lower than a good pact that the usa try a people are excluded from your own revenues. Earnings on what the newest income tax is only simply for pact, but not, is roofed within the gross income. If perhaps you were repaid because of the a different workplace, your You.S. resource earnings can be exempt away from You.S. taxation, however, only when you meet among the issues chatted about next. So you can be considered since the portfolio focus, the attention have to be paid off to your personal debt granted once July 18, 1984, and you can if you don’t subject to withholding.